what happens to my fers medical retirement when i turn 62

Special Benefit for Some FERS Who Retire Earlier Age 62

Have you heard nigh the FERS Supplement?

It'south an of import benefit for FERS planning to retire before historic period 62 – merely information technology'south then unknown, it's practically a secret.

The FERS Supplement is also called the Special Retirement Supplement or SRS. It is designed to assist bridge the money gap for sure FERS who retire before age 62. It will supplement your missing Social Security income until y'all attain age 62.

But not all FERS are eligible to receive the Supplement.

Rules of Eligibility for FERS Supplement

The first rule might audio obvious – but people really do ask… Yep, you lot must be in the FERS Retirement system to become the FERS Supplement.

And the Supplement is unique to FERS – in that location is no analogue to the Supplement in the Ceremonious Service Retirement Arrangement (CSRS).

The 2nd requirement is that yous must have a normal immediate retirement, not an early retirement (MRA+x). This means you must have 30 years of creditable service and meet your MRA. Or you can accept 20 years of creditable service and exist age lx.

And while you tin can seek a normal firsthand retirement at age 62 with v years in service – the Supplement is only paid until age 62. Then if you retired at 62 with v years of service, you would not get this benefit.

Special Rules for Special Provisions

I want to annotation here that Special Provisions FERS (ATC, LEO or FF) take some different rules for the Supplement. Click hither if you are Special Provisions.

Estimating the FERS Supplement

The calculation for the FERS Supplement is extremely complex and time-consuming. If you're interested in an exact calculation, check out the OPM CSRS/FERS Handbook,Chapter 51, Retiree Annuity Supplement

Near people are fine with an estimate for initial planning purposes. The easiest mode to get a ballpark on your Supplement involves your Historic period 62 Social Security benefit.

In society to judge your Supplement corporeality, you'll want to accept your annual Social Security argument handy. Y'all'll likewise need to know how many years of creditable service you would take at your estimated retirement.

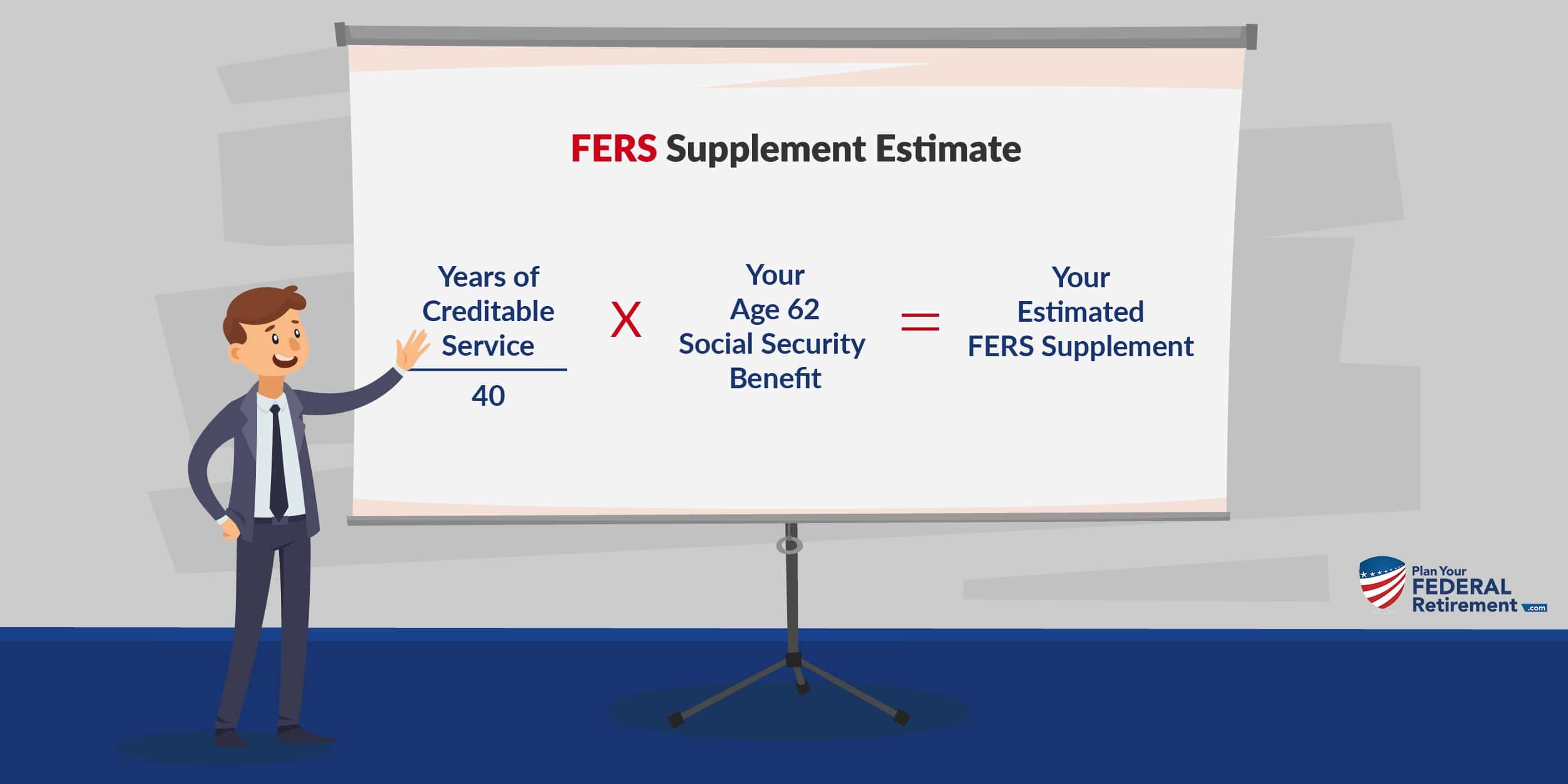

Theestimate formula is…

Years of Creditable Service: this is the number of years that count towards your retirement, and maybe some military time. (Time in military service counts here *but* if information technology was performed during a period covered by war machine get out with pay or get out without pay from civilian service. See Section 51A2.1-3 of the CSRS / FERS Handbook)

40: this is a fixed number and does non change

Your Age 62 SS Benefit: Yous'll detect this number on page two of your Social Security argument. And it doesn't thing what age you lot plan to start receiving Social Security – for this formula, you must employ the age 62 Social Security do good amount.

Yous tin can see that almost by design, the Supplement will exist less than your Historic period 62 Social Security benefit. Unless, of course, you have 40 years of service.

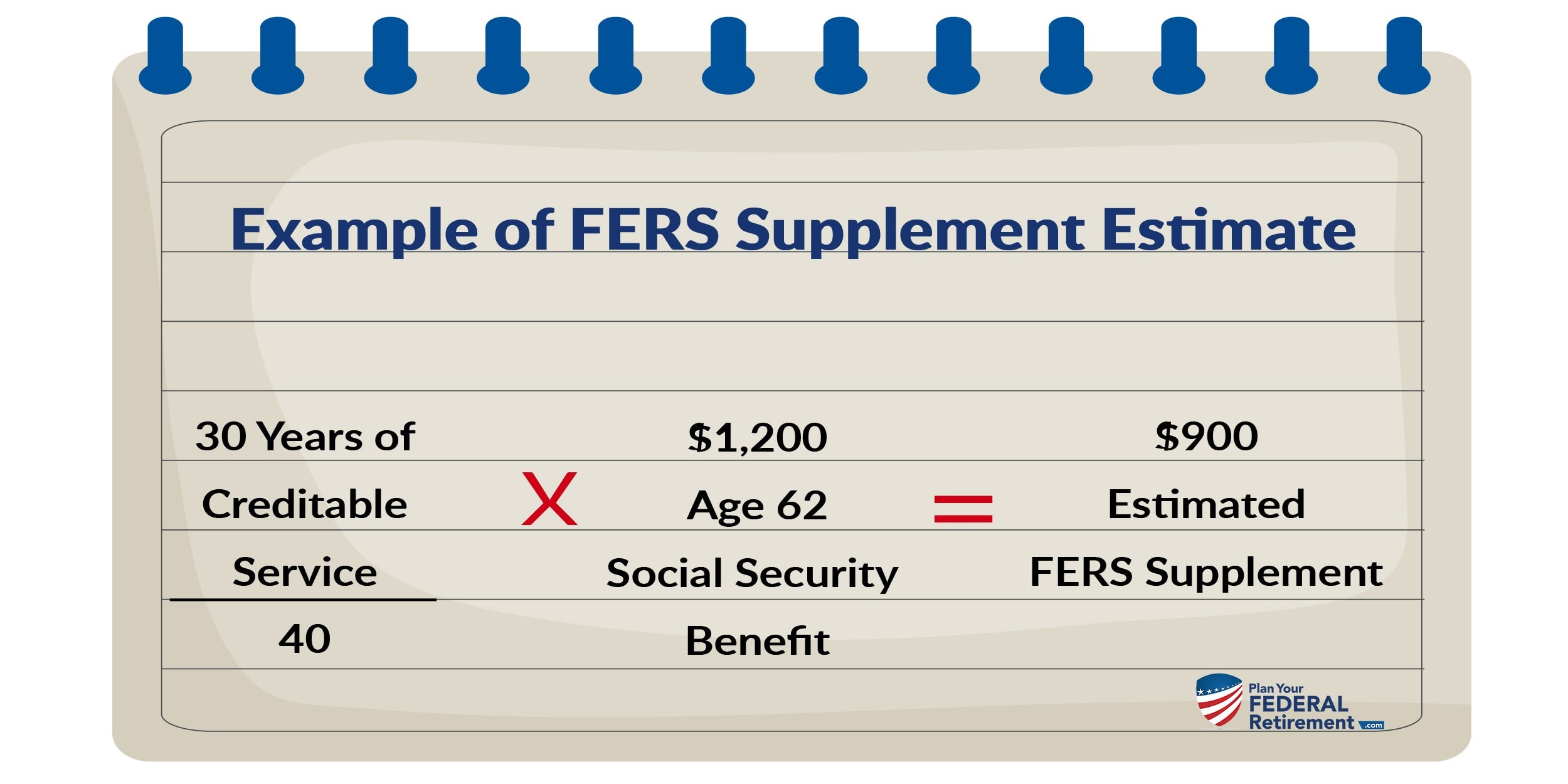

Let's walk through an instance together…

Say Jane is a FERS, and she will retire with thirty years of creditable service. She has reached her MRA, which is 57. And her age 62 Social Security do good will exist $one,200 a month.

Approximately how much will her FERS Supplement exist?

Well, we accept 30 years of service divided by 40 (30/forty) = .75 Now take .75 times $1,200 (her age 62 SS do good) = $900.

So Jane's Supplement volition exist approximately $900 a month. And she'll receive this supplement in one case she retires and upwards until the calendar month she turns 62.

Just nosotros're non done quite yet.

That is an gauge of the gross amount, but what is the approximate net amount Jane volition receive?

Will Jane's Supplement be subject to whatever reductions? And will it exist subject to taxes?<

Very probable. The government giveth, and the regime taketh abroad.

Reduction in FERS Supplement

The Supplement is treated much like Social Security Income.

And if you lot take any Social Security income before your Total Social Security Retirement Age (Your FRA varies from 65 to 67 depending on the yr you were born) your Supplement is discipline to a reduction and possibly taxes.

If y'all will take earned income (ex: a part-time job) subsequently you retire from Federal service, your Supplement may be reduced.

The reduction is significant and considering the income threshold is so low, it will impact many FERS retirees.Especially FERS who plan to get another chore, even a part-time job, after they retire from Federal service.

Back in the 1990'due south, there were some large changes to the manner Social Security was taxed. The government decided that they would reduce the amount of Social Security (and FERS Supplement) someone could receive before they reached their Full Retirement Age (for Social Security) and if they earned more than a sure amount. These changes go on to impact the FERS Supplement today.

In 2019 the earnings limit is $17,640

What counts toward that limit? Earned income – which is essentially any income you receive as a W-2 wage. So if you earn more than $17,640, your FERS Supplement will be reduced. For every $2 you earn above the limit, your FERS Supplement will be reduced by $1.

Here'southward How the Reduction Works –

Let'southward go back to our case with Jane. Say Jane gets a part-fourth dimension task later on her federal retirement. That job pays her $30,000 a year, which is $12,360 over the income limit.

Half of $12,360 is $half dozen,180, which is her annual reduction. Divide that by 12, and we get a reduction $515 a month.

Earlier, nosotros estimated Jane's Supplement to be $900 a month. In one case we factor in her reduction, we encounter that Jane'southward Supplement volition really be closer to $385 a calendar month.

Only we have ane more hurdle before nosotros really know what Jane's net amount will exist. Taxes…

Taxes and the FERS Supplement

When we discuss the Supplement in the FERS Pre-Retirement classes I teach, some people recall, "If the authorities already reduced my FERS Supplement – surely they won't taxation it too."

Well – they can – and they exercise.

While the reduction in the FERS Supplement is calculated by the Social Security reduction rules; the way the FERS Supplement and Social Security are taxed is different. While the majority (merely not all) of your Social Security income volition likely be subject to tax; ALL of your FERS Supplement volition exist subject to ordinary income tax.

Looking at Our Example…

Going back to our example with Jane – she has a function time task that pays her $xxx,000 a year. In our example, her Reduced FERS Supplement was approximately $385 a month. Taxes are complex, but for the sake of easy numbers allow's say she pays taxes at a rate of 15%. 15% of $385 would be $58, leaving Jane with a FERS Supplement of $327 a month.

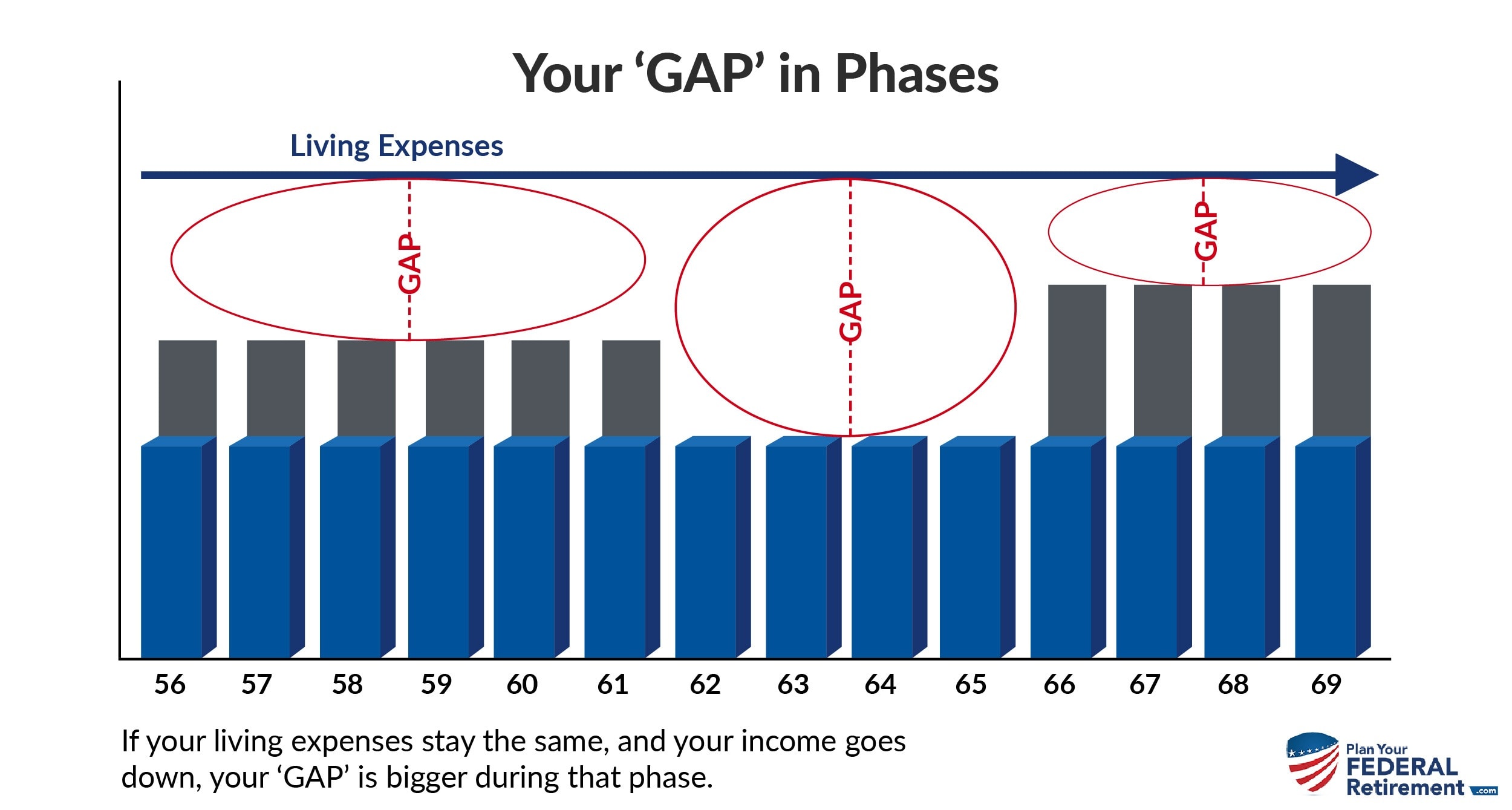

Mind the Gap: FERS Supplement to Regular Social Security

The FERS Supplement will end the month yous turn age 62. And it stops whether or not y'all have started drawing Social Security at age 62.

Some people may choose to showtime cartoon Social Security at age 62 – only others will desire to delay until later.

Why delay?The longer you wait, the higher your benefit will be. That is, up until age 70. The amount will non increase if you wait any longer than historic period 70 to draw Social Security.

But if you delay drawing Social Security to go a larger benefit – information technology means you have to go that many more than years without the monthly benefit.

This tin create a coin gap – and it's important to plan ahead for it.

Everyone'southward personal financial state of affairs is unique – so yous'll want to carefully counterbalance your financial plans to see when it makes the almost sense for you to start cartoon Social Security.

This is but one of the things I aid my clients with. You can click here to observe out more about how I assist my federal employee clients.

Source: https://plan-your-federal-retirement.com/fers-supplement/

0 Response to "what happens to my fers medical retirement when i turn 62"

Post a Comment